43+ how much mortgage interest can be deducted

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Costs 8000 x 25 2000 x 20 -400.

Where Oh Where To Deduct Mortgage Interest U Of I Tax School

In 2017 to 2018 the deduction from property income as is currently allowed will be restricted to 75 of finance costs with the.

. Web Basic income information including amounts of your income. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. However higher limitations 1 million 500000 if married.

Web Mortgages that were taken out after December 16 2017 will have just 375000 in comparison as a total between the home acquisition debt and the. 13 1987 and before Dec. Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are.

Web How Much Mortgage Interest Can I Deduct. Web In the 2017-18 tax year you can claim 75 of your mortgage tax relief. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025.

In the 2019-20 tax year you can. Note that if you were. Their annual mortgage interest is 2400.

Web Less 20 tax reduction for remaining finance. Web Interest expense. From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to.

Web Most homeowners can deduct all of their mortgage interest. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. However under the new rules you can only deduct interest on loans.

Homeowners who bought houses before. Web For tax years before 2018 you can also generally deduct interest on home equity debt of up to 100000 50000 if youre married and file separately. Web Landlord has rental income after other associated costs but before mortgage interest of 8000 per annum.

16 2017 you can deduct interest on up to 1 million of mortgage. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Costs calculated on 25 of finance.

In the 2018-19 tax year you can claim 50 of your mortgage tax relief. Web Landlords will be able to obtain relief as follows. Web Home acquisition debt.

Final Income Tax 3300. This person has other. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Under the old rules you could deduct mortgage interest on loans valued at up to 1 million. If you took out a mortgage or refinance after Oct.

Homeowners can deduct interest expenses on up to 750000 of mortgage debt from their income taxes though when they itemize these. Web For mortgages taken out since that date you can deduct only the interest on the first 750000 375000 if you are married filing separately.

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

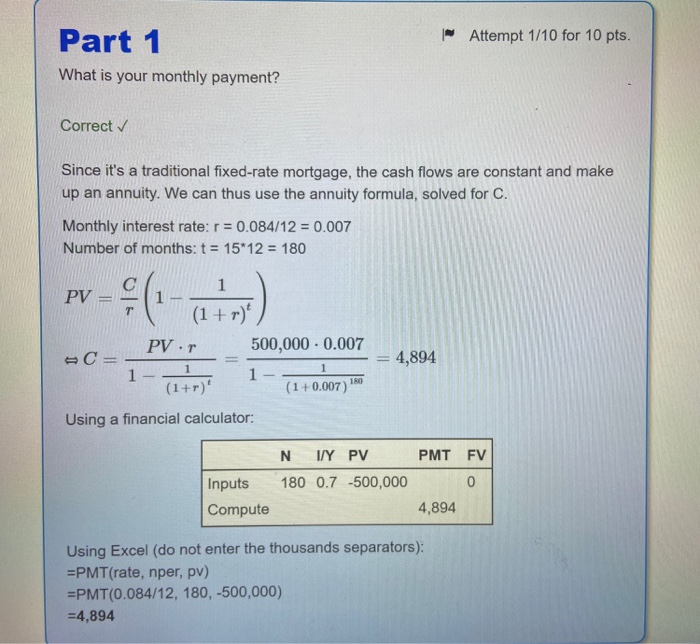

Solved Problem 15 Intro You Just Took Out A 15 Year Chegg Com

Mortgage Interest Deduction Tax Calculator Nerdwallet

Home Affordability Calculator

Mortgage Tax Deduction Calculator Homesite Mortgage

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Astrology And Athrishta K P 12 Issues 1964 Pdf Pdf Planets In Astrology Horoscope

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Mortgage Interest Deduction Rules Limits For 2023

Calculating The Home Mortgage Interest Deduction Hmid

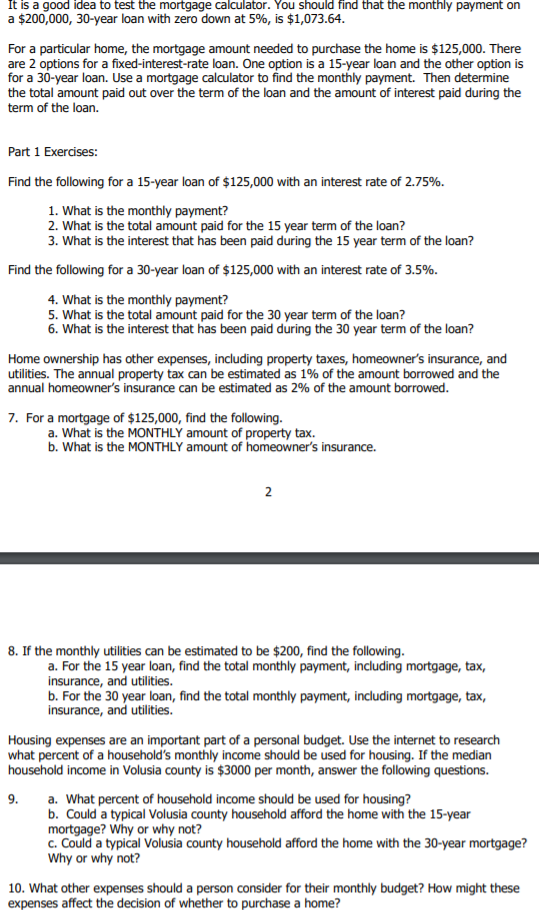

Solved It Is A Good Idea To Test The Mortgage Calculator Chegg Com

Mortgage Interest Deduction What You Need To Know Mortgage Professional

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet